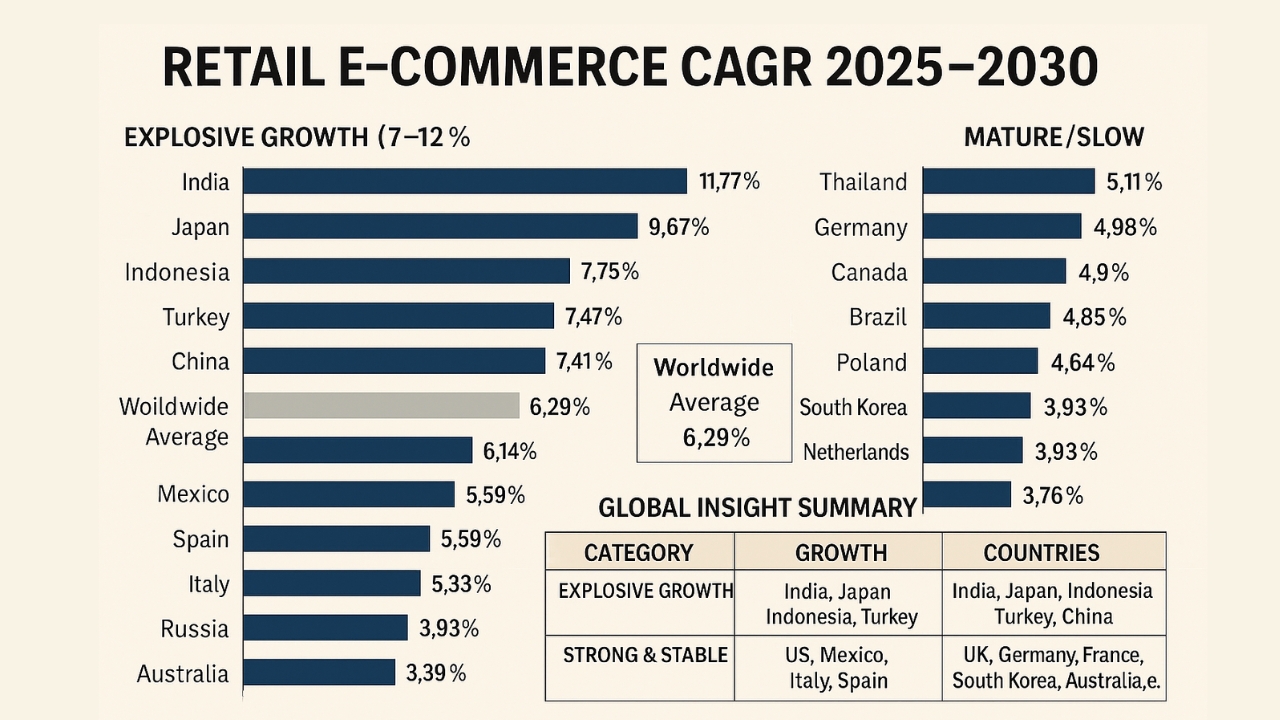

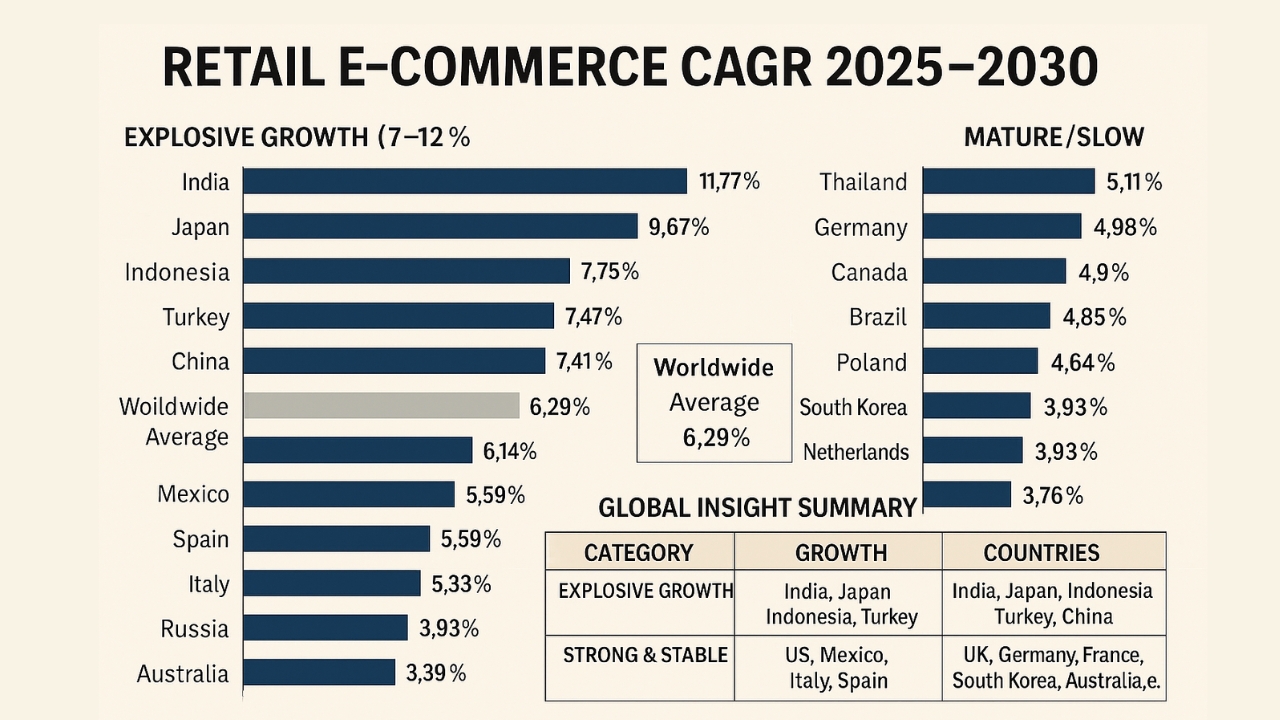

Retail e-commerce sales compound annual growth rate (CAGR) from 2025 to 2030 by country

Written By

Bikash Yadav

SEO EXPERT

SEO Expert & Digital Marketing Strategist with 8+ years of experience helping businesses grow online. Read more

Note: These statistics have been taken from statista.com

The chart compares the compound annual growth rate (CAGR) of retail e-commerce across major economies from 2025 to 2030. CAGR shows one thing:

How fast will the e-commerce market grow each year on average?

A higher CAGR indicates faster market expansion and more opportunities.

Here’s how the landscape looks.

These countries are about to experience an e-commerce boom. If you want an early mover advantage, this is where you look.

India leads the world. That means:

• Rising middle-class income

• Cheaper internet

• Tier-2 and Tier-3 cities shopping online

• Exploding mobile penetration

India will be the most important e-commerce battleground of the next five years.

Japan is already a mature economy, so a 9.67% CAGR is massive.

This reflects aging demographics + convenience-driven shopping + fast logistics.

Young population + mobile-first behavior = huge potential.

High digital adoption and a rising entrepreneurial market make Turkey a sleeper giant.

Already the world’s largest e-commerce market, and still growing fast.

What this category means:

These markets will attract:

• More cross-border sellers

• Global brands expanding aggressively

• More payment and logistics innovation

If you’re entering early, you get lower competition and cheaper acquisition.

This benchmark helps you compare:

Above 6.29% = outperforming the world

Below 6.29% = slower-than-global growth

Growing economy + strong mobile adoption.

Huge opportunity for D2C brands.

Stable growth, rising online grocery, fashion, and electronics.

The U.S. is large, established, and competitive — but still growing at a solid pace.

This growth is mostly driven by:

• Subscriptions

• Quick-commerce

• Same-day delivery

• Social commerce

E-commerce adoption is still climbing steadily.

What this category means:

These markets are great for brands seeking stable, lower-risk, long-term growth.

These are markets where e-commerce is already developed, so growth slows down.

Here’s what’s happening:

• These markets already have high online shopping penetration

• Competition is fierce

• Logistics and payments are mature

• Incremental growth is harder to achieve

What this category means:

Winning here requires better branding, stronger fulfillment, and innovation — not just “being online.”

If you sort the world into opportunity clusters:

This tells us one thing:

The next wave of e-commerce dominance will come from Asia and emerging markets.

Choose countries above the worldwide CAGR average of 6.29%.

These are the markets where your store will naturally grow faster.

Priority markets:

India, Japan, Indonesia, Turkey, China, Mexico

Markets with >7% CAGR deserve deeper investment:

• Local language SEO

• Faster delivery options

• Local influencers

• Marketplaces (Flipkart, Shopee, Lazada, Rakuten, Trendyol)

High-growth markets invite new brands.

If you enter late, ad costs rise and margins shrink.

Enter early to lock in:

• Market share

• Loyal repeat buyers

• Cheaper acquisition

Slow-growth markets (UK, Germany, France, Australia) have high CPCs and heavy competition.

Better strategy:

• Niche positioning

• Strong brand building

• Subscription or loyalty programs

• Higher-quality content and CRO

Countries like India, Indonesia, and Turkey are mobile-dominant markets.

Invest in:

• Fast mobile pages

• Wallet payments

• App-based selling

• Social commerce

If CAGR >7%, the market is in growth mode → higher potential returns.

If CAGR <5%, the market is in maturity mode → safer but lower-return investments.

Launch your tools in fast-growth regions first:

• Logistics and warehousing tools

• Chatbots

• Payment solutions

• Marketplace management

• Customer retention tools

Fast-growth countries adopt tech faster.

The U.S. or Europe will not shape the next five years of e-commerce.

It will be shaped by Asia, led by India, Japan, Indonesia, Turkey, and China.

Understanding these numbers helps you:

• Choose the right countries

• Spend money where growth is rising

• Avoid saturated markets with low ROI

• Build faster, smarter, and with less risk